The Real Estate Financial Planner™ Blog

Welcome to the thrilling world of Real Estate Financial Planning! If you’re on the hunt for savvy investment strategies, transformative financial insights, and the ultimate guide to building wealth through real estate, you’ve just hit the jackpot. Whether you’re a seasoned investor or just dipping your toes into the vast ocean of real estate opportunities, our blog is your new go-to resource.

Why real estate, you ask? Simple. It’s one of the most powerful vehicles for generating long-term wealth and achieving financial freedom. And who doesn’t dream of that? But here’s the kicker: navigating this world can be as complex as it is rewarding. That’s where we come in. Our content is designed not only to enlighten you but also to inspire action and drive results.

Imagine unlocking the secrets to acquiring lucrative rental properties that pay for themselves and then some. Picture yourself living off passive income, where your investments work for you, not the other way around. It’s not just a dream; it’s a very achievable reality, and we’re here to show you how.

From deep dives into market analysis, investment strategies, and financial planning, to actionable tips on property management and scaling your portfolio, our blog covers it all. We believe in cutting through the noise to bring you straightforward, actionable advice that makes a difference.

But it’s not just about the “what” and the “how”; it’s also about the “who.” Meet James, a former real estate broker turned investment guru, who lives and breathes real estate. James has walked the walk, transforming his passion for real estate into a thriving portfolio of income-generating properties. Now, he’s here to share his wealth of knowledge, experiences, and insights with you.

Our mission is simple: to empower you with the knowledge and tools you need to make informed decisions, maximize your returns, and build a financial legacy through real estate. We’re here to guide you every step of the way, from your first investment property to your hundredth.

So, are you ready to embark on this exciting journey with us? Let’s dive in and explore the endless possibilities that real estate investing has to offer. Together, we’ll unlock the door to financial freedom and success. Welcome to the Real Estate Financial Planning blog, where your financial dreams are just a blog post away. Let the adventure begin!

The Ultimate Guide to Cash on Cash Return on Investment

Welcome to the Ultimate Guide to Cash on Cash Return on Investment for real estate investors (also known as “Cash on Cash ROI”). In this guide, we will start by discussing what the basic definition of cash on cash return on investment is and then move on to much more advanced and nuanced topics related to cash on cash. Cash on Cash Return on Investment = (Net Operating Income – Mortgage Payments) ÷ Purchase Price Cash on Cash Return on Investment is defined as the Net Operating Income (often abbreviated as NOI) minus all Mortgage Payments divided by the Purchase … Read more

The Ultimate Guide to Cap Rate for Real Estate Investors

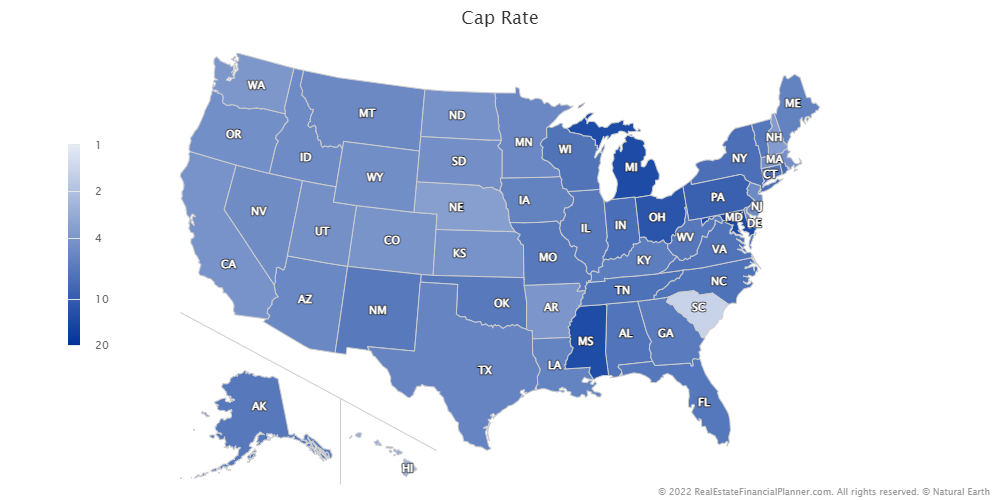

Welcome to the Ultimate Guide to Cap Rate for Real Estate Investors (also known as “capitalization rate”). In this guide, we will start by discussing what the basic definition of cap rate is and then move on to much more advanced and nuanced topics related to cap rates. Cap Rate = Net Operating Income ÷ Purchase Price Cap rate is defined as the Net Operating Income (often abbreviated as NOI) divided by the Purchase Price. In The World’s Greatest Real Estate Deal Analysis Spreadsheet™ cap rate is calculated for you. What’s a Good Cap Rate for Real Estate Investors? Cap … Read more

Are FHA Loans for Suckers?

In this class James discusses the pros and cons of using FHA loans. Are FHA Loans For Suckers? Their equivalent of Private Mortgage Insurance (PMI)–Mortgage Insurance Premium for FHA loans—is usually higher compared to PMI on conventional loans Their Private Mortgage Insurance never goes away You got to sell or refinance into a different loan to get rid of it Mortgage Interest Rates can be higher than for jumbo loans or VA loans There are lower down payment programs than just 3.5% down like conventional 3% down payment, VA and USDA nothing down loan programs as just a couple examples … Read more

Mortgage Interest Rate Confidence Meter™

Thinking about buying properties over the next several years? Are you wondering what a reasonable mortgage interest rate to use should be? Download and use the Mortgage Interest Rate Confidence Meter™ to see how reasonable your mortgage interest rate is using historical 30-year mortgage interest rate data from the Federal Reserve’s database of historical 30-year mortgage interest rate data going back to 1971. Download

The Lifestyle of Success Secret

So far, we’ve already discussed how to fail, how to be ordinary and how to be successful in the previous 3 parts: The Lifestyle of Failure The Lifestyle of Ordinary The Lifestyle of Success The Lifestyle of Success Secret (illustrated below) Now, let’s examine The Lifestyle of Success Secret to see how financially successful folks deal with their Daily Standard of Living and their Overall Standard of Living. Same set as previous parts: money measured on the left and time measured on the bottom. Money increases from bottom to top. Time increases from left to right. The money they earn … Read more

The Lifestyle of Success

We’ve covered The Lifestyle of Failure and The Lifestyle of Ordinary. Now, we will move on to part 3 in our series on examining how folks handle their money and how it impacts their financial security by talking about The Lifestyle of Success. The Lifestyle of Failure The Lifestyle of Ordinary The Lifestyle of Success (illustrated below) The Lifestyle of Success Secret In the The Lifestyle of Failure, we saw people living beyond their means and using debt that led, ultimately, to bankruptcy. In the The Lifestyle of Ordinary, we saw people living below their means and investing but spending … Read more